If a person dies in California without a Trust or Will, then Probate Code Sections 6400-6455, intestate succession, dictates the succession disposition.

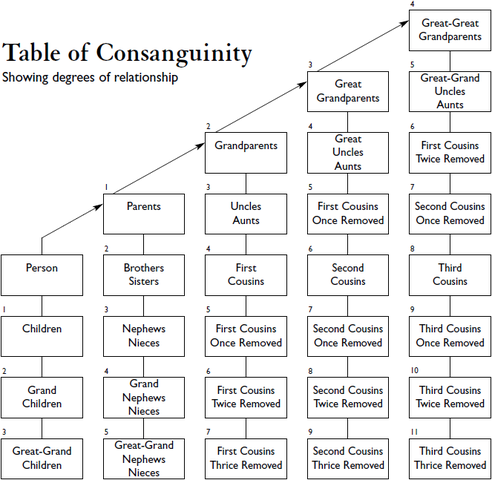

The attached Chart of Consanguinity details the various scenarios whereby the offspring of a predeceased direct bloodline relative can inherit by “right of representation.”

For example, the parents have two children, and one of the children predeceased, leaving two grandchildren. Under the California Probate Code, the two grandchildren are entitled to receive in equal shares the 50% of the pre-deceased parent child. The surviving grandchildren inherit 25% each.

In a situation where a single person has no direct bloodline and has an extended family with many cousins, who have offspring, the benefits of having a Trust or Will explicitly stating who will receive, will prevent the cost and burden of a Probate Administration leaving it to distant relatives that the decedent may not have known existed.

Court Probate of Intestate Administration for a deceased without a Trust or Will, can result in large Heir Search Vendor costs. This can be prevented by having a valid written Estate Plan, a Trust or a Will.