One of the main purposes of setting up a Trust is self-sufficiency, meaning I and my loved ones are able to handle our own affairs, and do not need to rely upon a government organization or agency.

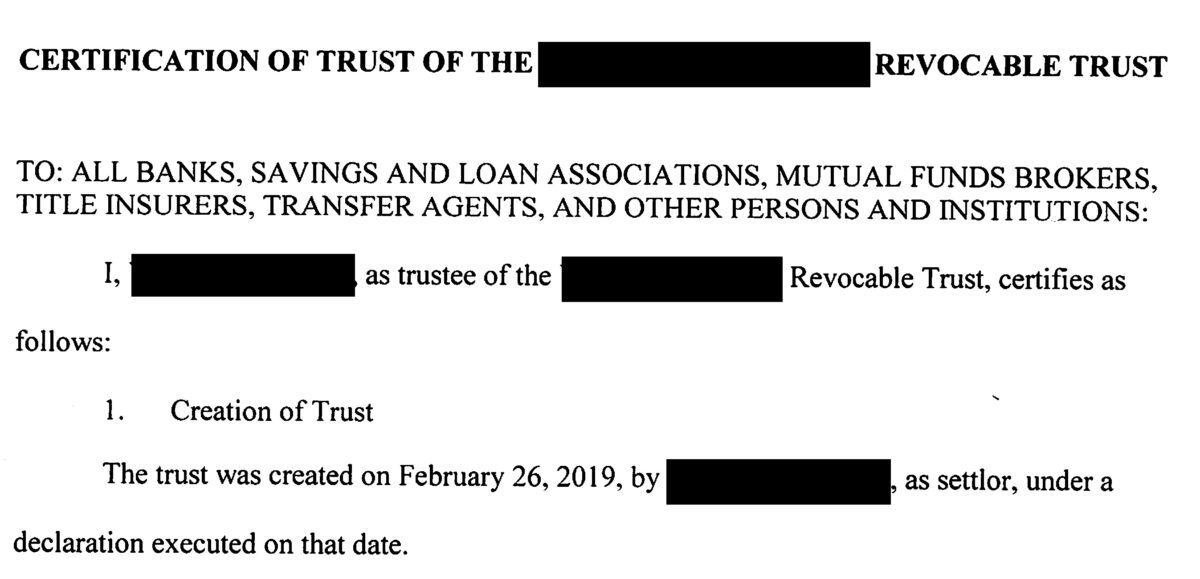

The way we do this is by putting it in “writing”, in a legal and regulatory manner, that will be accepted by the financial and governmental organizations.

With the present Covid-19 virus, it is more clear than ever that our government is overwhelmed and lacks the resources to take care of all those who need it. Courts are shut down or have significantly delayed and reduced services.

Thus the “Planning” in Estate Planning is the most important aspect. Preparing in advance for a probable and certain event is a no-brainer. We will all die. Real life experience tells us that more “goes wrong” than right, and that hoping for wining the lottery ticket is a fool’s errand.

If you have time and capability now, why wait for the stressful and frustrating emergency to materialize, requiring an “immediate resolution”, only to find that you must rely on the governmental system and “get in line” of a large backlog of others.

When you set up a Trust you designate a successor Trustee who will wind down your affairs upon death. It is advisable to transfer or relate as many assets (e.g. real estate, financial accounts, life insurance) to the Trust allowing for a complete bypass of the Probate Court process.